Prescription drugs are the tip of the spear when it comes to lowering overall healthcare costs.

When looking for solutions to the healthcare cost crisis, the first place to start is with prescription drugs.

Prescription drugs make up 90% of all healthcare transactions and account for nearly 50% of profits accrued in healthcare — with another 10% of prescription drug profits being sucked up in the supply chain. With this many exchanges, the money spent on fulfilling them and the markups added by middlemen, the opportunity for impact and savings is enormous.

The public is demanding it. High prescription costs are a constant pain point. Seventy percent of prescriptions are recurring, which means many Americans face outrageously high prices every single month when they go to the pharmacy to pick up their medications. That’s likely one of the reasons why getting access to more affordable medications is turning into a priority issue for voters, too. In March 2018, 52% of the public said passing legislation to bring down prescription drug costs should be a top priority. In May 2018, the majority of registered voters (71%) also said they’d be more likely to support a candidate who supported lowering drug costs.

Part of what makes the prescription market so complicated is that most people aren’t aware that there are actually two completely different markets: the generic market and the branded market. These markets have different economics (that behave very differently) and different high-price culprits.

Generic vs. brand prescription drug markets

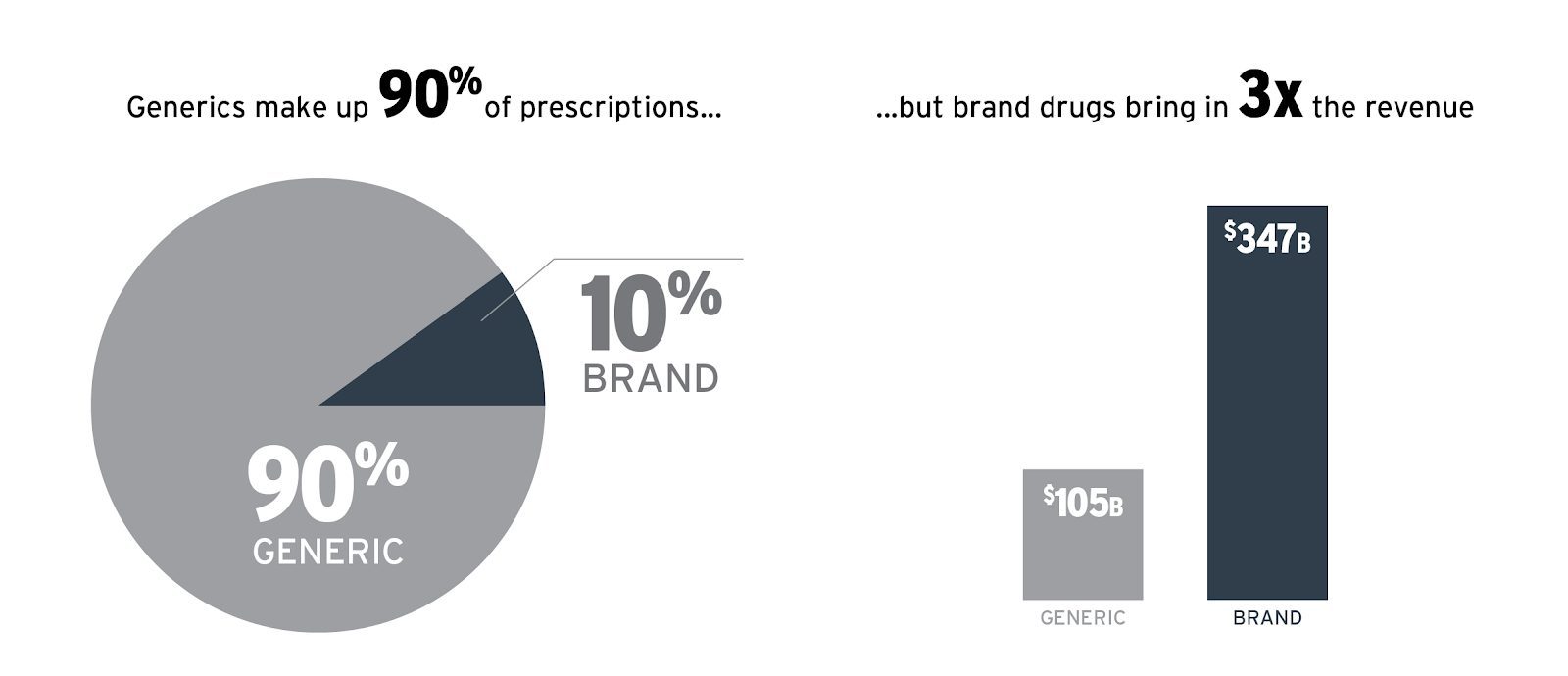

Brand and generic drugs have a similar journey to the patient: they go from the manufacturer to the wholesaler to the pharmacy to the patient. That’s where the similarities end. Generic drugs account for the great majority of prescriptions dispensed in the United States; however, brand drugs, even though they only represent 10% of prescriptions dispensed, bring in much higher revenues.

Who makes the money in each market?

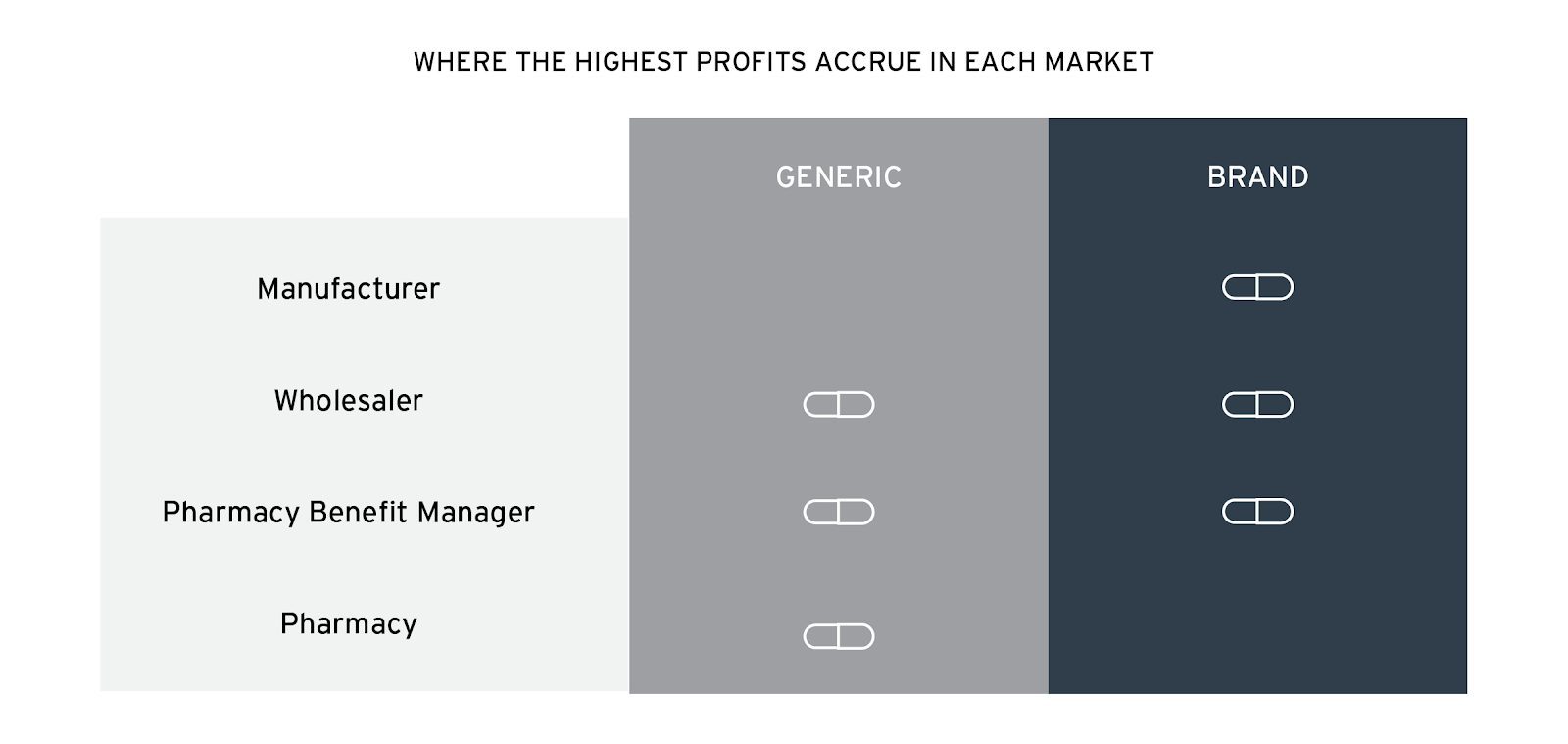

As each type of drug moves through the system, different supply chain players take their share of the overall profits — often liberally. How much each supply chain player makes depends on the market.

The generic drug market

Generic drugs are off-patent commodities. They are really no different than white bread, rice or any other food staple. Because any manufacturer can produce a generic medication, manufacturer margins are low for these products. In fact, generic manufacturer profits have never been lower. So why are consumer out-of-pocket prices for generic medications so high?

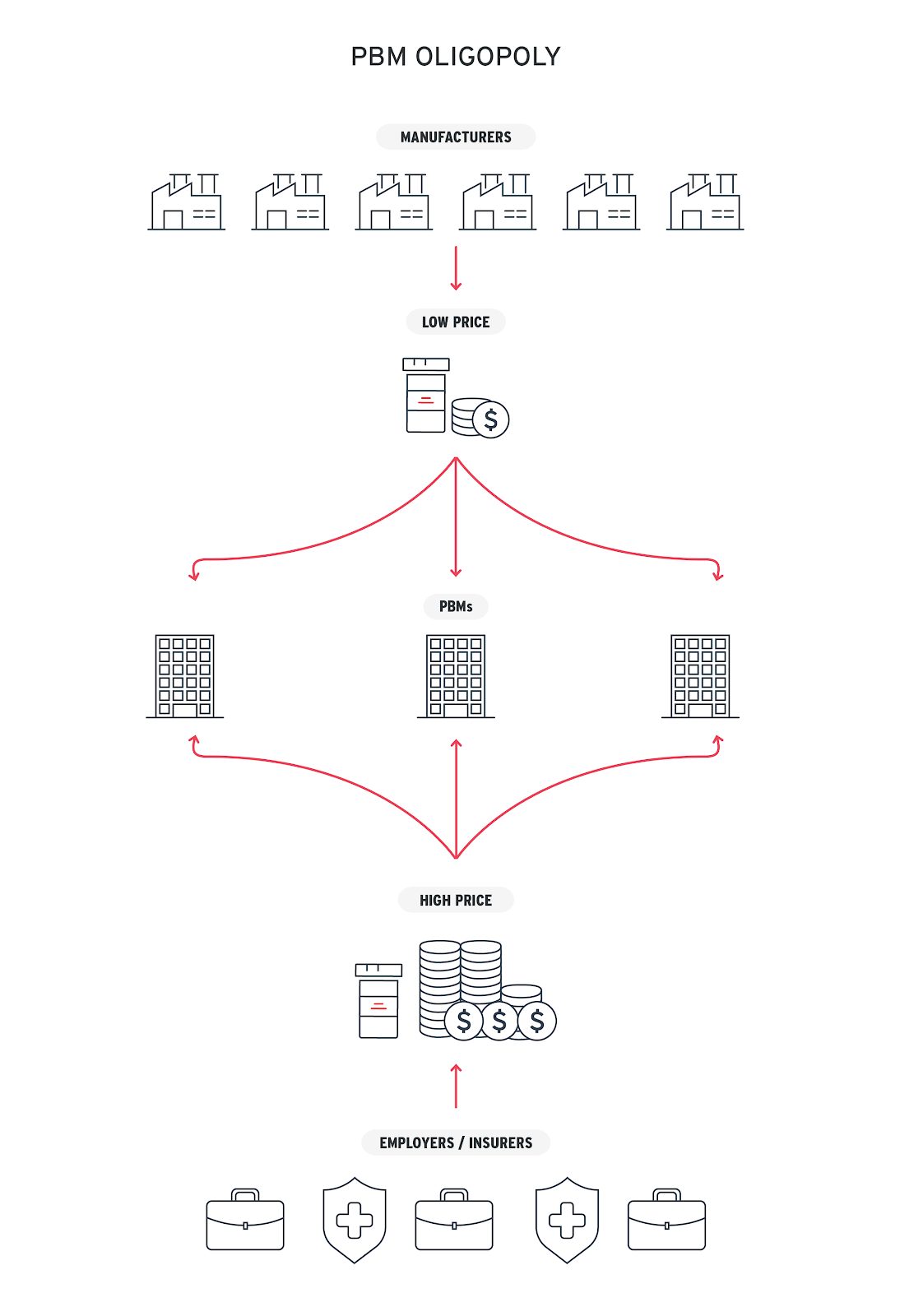

The short answer is a lack of competitive forces driven by pharmacy benefit manager (PBM) oligopolies.

PBMs determine the amount that a pharmacy gets reimbursed by a payer (an insurance company or the patient) for a particular medication. There are only three major PBMs in the U.S. that now control 80% of all drug spending. The PBM supplier is the pharmacy and the PBM customer is the insurance company and the patient. Because pharmacies depend on these three PBMs to get access to patients, pharmacies have no choice but to accept the low reimbursements they receive from PBMs.

Negotiating these lower costs should be a good thing, right? In reality, that’s not the case. Because there are only three major PBMs, insurers, employers and individuals have limited options and therefore can’t force these three large companies to compete by offering better value to their clients. That leads to PBMs keeping the benefits of the low prices they negotiate with pharmacies, without having to pass them on to their clients. Voila: high prices for consumers.

The branded drug market

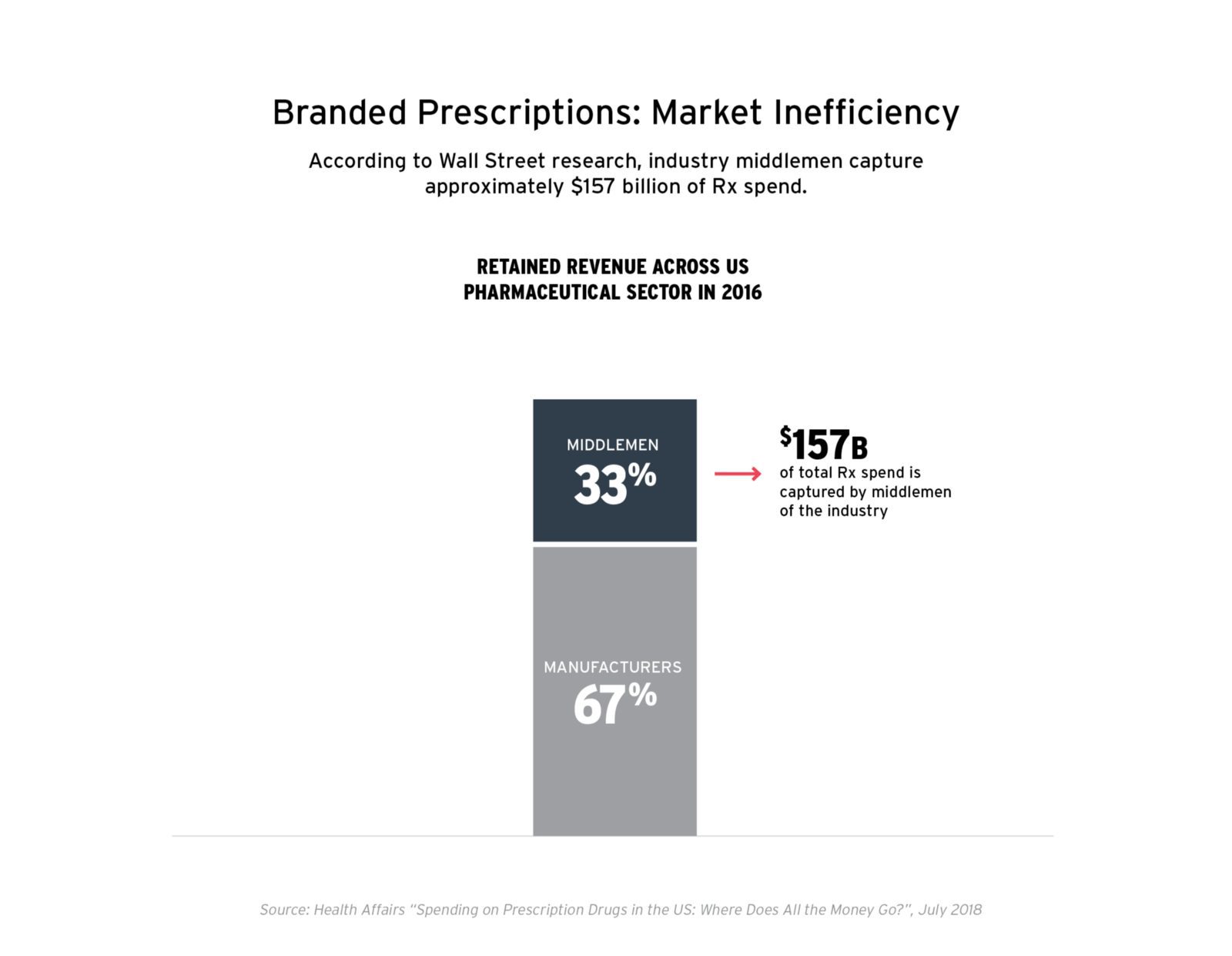

The majority of profits from branded drugs accrue to the inventor and manufacturer of the drug because they have a patent on the medication that grants them a legal monopoly to sell the product for a set amount of time. Amazingly, however, more than 30% of the profits associated with branded medications also flow into the black hole of middlemen who move product and money around outside of much scrutiny.

A major cause of unnecessary price inflation for branded drugs is the consolidated PBMs. Of the three PBMs that represent 80% of transactions, only two PBMs, Express Scripts and CVS Caremark, represent around 80% of the negotiated rebates with pharmaceutical manufacturers. They rent their negotiated rates to all other PBMs, who add their own mark ups.

What is not widely known here is that the PBM market for negotiating with manufacturers is even more consolidated than most people realize. These PBMs are supposed to negotiate with manufacturers to lower the price of branded medications on behalf of their clients. Given that two PBMs effectively negotiate on behalf of the whole country, they do wield a lot of power to get discounts. The problem is that their clients have nowhere else to go to access any discounts, so instead of those discounts being passed down to the client, the PBM is able to keep a huge portion as profit — around $300 million, in the case of CVS in 2018, according to their CEO.

Focus on the middlemen

Looking at both markets, it’s clear that consumers spend more than they need to on a product that, for many, is an absolute necessity. It’s also clear that the system can’t continue with business as usual for much longer. Even the general public is taking note of these often-hidden middlemen; in a February 2019 survey, the Kaiser Family Foundation found that 63% of respondents believe that PBMs are a “major factor” in manufacturers setting high drug prices.

Instead of only looking to pharmaceutical manufacturers who are investing billions of dollars to develop new drugs and have a very low return on invested capital, we should be focusing on the low-hanging fruit — the industry middlemen — who are driving up the price of drugs by 30%+ without providing much value to the system.