Cancer has touched most people’s lives, either through being a survivor or having seen a loved one experience it. In the U.S., the risk of developing cancer for men is 1 in 2 and 1 in 3 for women. It is insidious and can strike anyone at any time. In 2018, an estimated 1,735,350 new cases of cancer will be diagnosed in the United States. In 2016, there were an estimated 15.5 million cancer survivors in the United States. The number of cancer survivors is expected to increase to 20.3 million by 2026. In 2017, an estimated 15,270 children and adolescents ages 0 to 19 were diagnosed with cancer. Estimated national expenditures for cancer care in the United States in 2017 were $147.3 billion. In future years, costs are likely to increase as the population ages and cancer prevalence increases. Costs are also likely to increase as new, and often more expensive, treatments are adopted as standards of care.

A critical illness policy will cover more than cancer. Every year, 735,000 Americans have a heart attack. The average cost of a heart attack is $125,013. After major medical coverage, the average person could still owe $50,005 in out-of-pocket medical expenses not covered by their insurance. To put that in perspective, that same person could purchase 50 smart phones, take 16 vacations to Hawaii, or go on 29 ski trips to Utah. Also, every 40 seconds, a person suffers a stroke. That translates into approximately 795,000 people suffering a stroke. About 600,000 of these are first attacks, and 185,000 are recurrent attacks. Strokes can and do occur at ANY age. Nearly one fourth of strokes occur in people under the age of 65. From an insurance perspective, stroke is the leading cause of serious, long-term disability in the United States. About 92.1 million American adults are living with some form of cardiovascular disease or the after-effects of having a stroke. Direct and indirect costs of total cardiovascular diseases and stroke areestimated to total more than $329.7 billion; that includes both health expenditures and lost productivity.

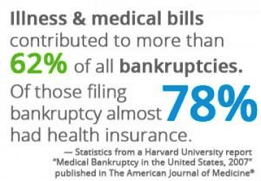

In many circumstances, there are no warning signs and they do not discriminate. Besides the physical and psychological effects of a major illness, there is the real world concern of finances. The reality is 62% of all bankruptcies are the result of a medical issue, and 78% of people who went bankrupt because of medical costs had comprehensive health insurance. About 55% of U.S. households could not replace a month of their income. Moreover, 47% of households indicate that they could not cover a hypothetical emergency expense costing $400 without selling something or borrowing money. A critical illness policy pays the insured directly and has no restrictions. The client can pay for out of pocket medical expenses, prescriptions, or even their rent or mortgage. In can make a tremendous difference for a large portion of the population.

Call me to get a Price!!! 704-891-2274